By Jason Buxbaum

Key Takeaways

- Interest Rate Fatigue: Many people are overwhelmed by the constant discussion and impact of rising interest rates, which affect everyday shopping and create uncertainty due to differing forecasts from economists.

- The Importance of Flexibility for the Fed: Initially, low Federal Funds rates (0-2%) limited the Federal Reserve’s ability to respond to economic challenges. However, the recent actions taken by the Fed, including acquiring trillions in mortgage-backed securities and treasury bills, have provided it with the flexibility to adjust rates as needed, which is crucial for addressing inflation and future crises.

- Response to the Pandemic: The Fed’s aggressive monetary policy response to the financial strains brought on by COVID-19 showcased its capacity to act decisively in crisis situations, moving from a zero interest rate policy to a position where it now has the ability to both lower and raise rates in response to economic conditions.

- Economic Resilience and Growth: The successful auction of a record amount of ten-year Treasury notes without issue highlights the underlying strength and growth of the economy, suggesting a positive outlook for handling debt and future economic challenges.

- Focus on the Big Picture: Despite the noise and fear surrounding interest rates and economic forecasts, there have been significant improvements and strategic moves that enhance the Fed’s ability to manage economic crises, indicating the importance of looking beyond immediate concerns to understand the broader economic landscape and its potential for resilience.

Introduction to Interest Rate Fatigue

In today’s economic climate, it’s hard to escape the omnipresent discussions about interest rates. Whether it’s the impact on our daily shopping experiences or the bombardment of forecasts and predictions from financial experts, the topic of interest rates is inescapable. But what if we shifted our focus from the incessant chatter to the broader, systemic improvements that have been quietly shaping our economy since the onset of inflation’s rise?

The Federal Reserve’s Limited Flexibility Explained

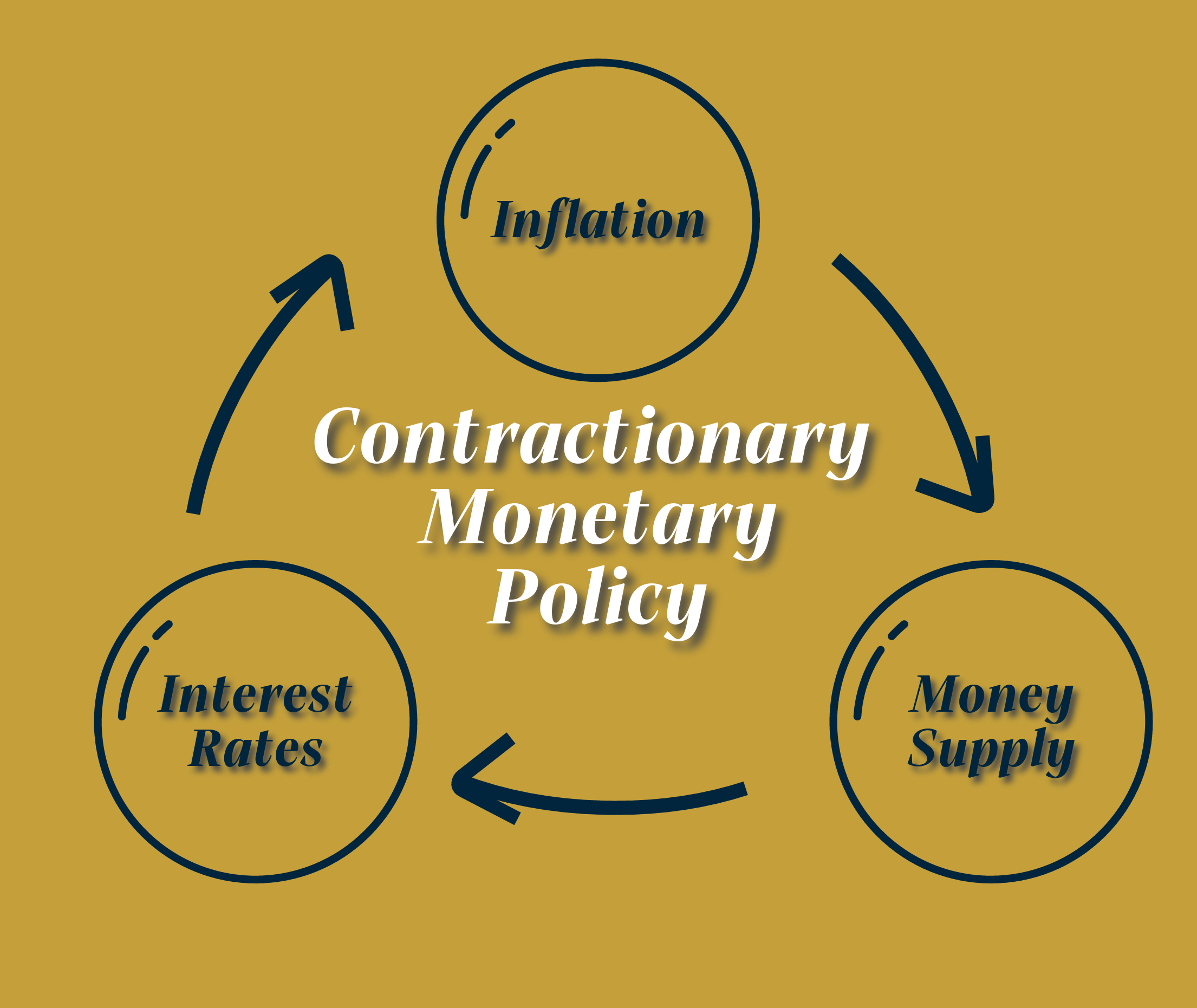

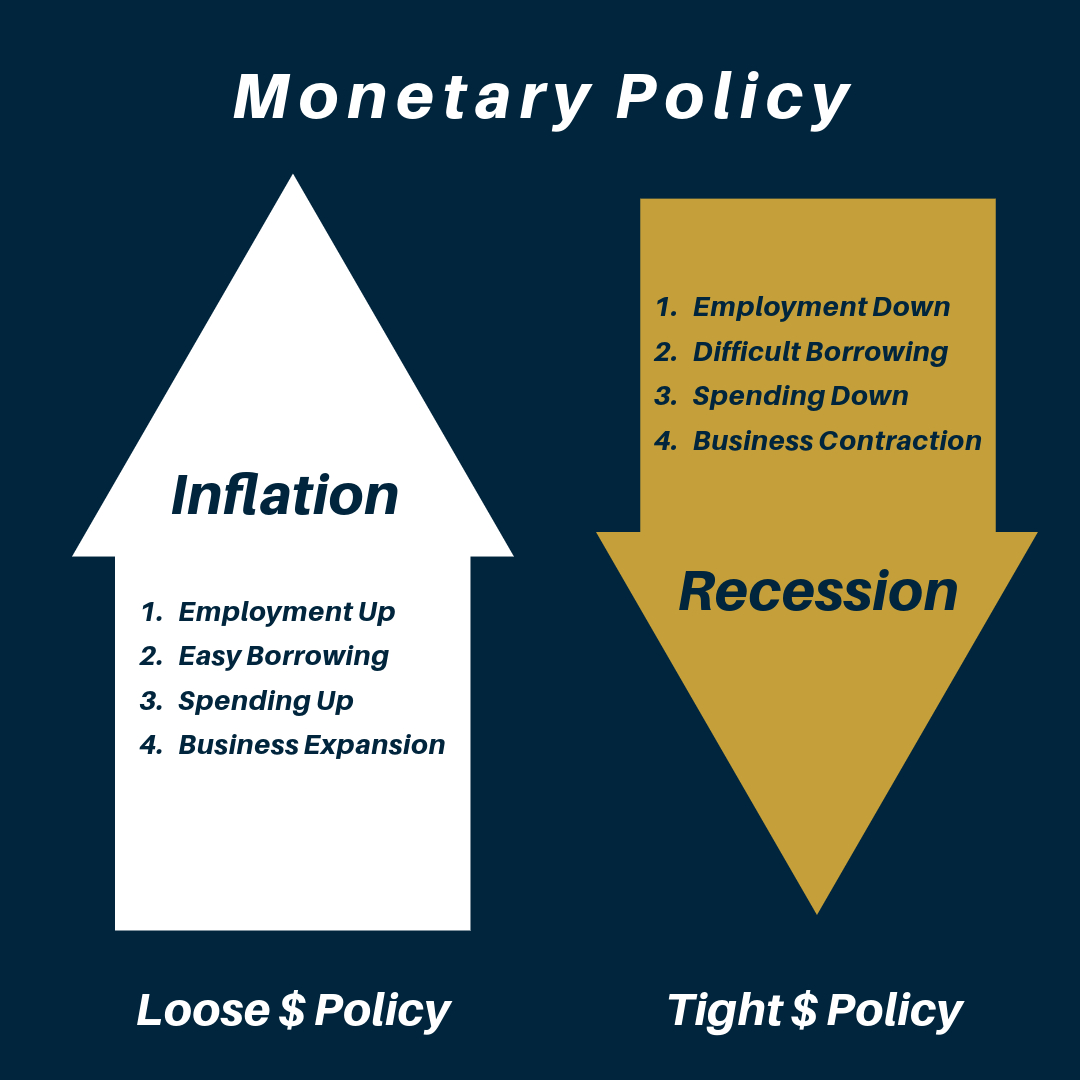

- Historical Context and Present Challenges: Initially, the Federal Reserve (the Fed) faced significant limitations with Federal Funds rates hovering between 0 and 2%. This narrow range left the central bank with little room to maneuver in response to economic shifts, tethering us to the speculative world of forward yield curves. These curves, when trending upwards, signal potential difficulties ahead for leveraged purchases and corporate profits, reflecting the broader implications of interest rate adjustments on the economy.

- The Psychological Impact of Economic Uncertainty: The fear surrounding interest rates isn’t just a matter of financial inconvenience; it’s a profound concern that these rates, in their historic lows, might not be sufficient to fend off looming economic crises. This fear is compounded by the realization that, in such a scenario, the Fed could find its arsenal worryingly depleted.

A Strategic Shift in Response to the Pandemic

- Unprecedented Measures for Unprecedented Times: However, the narrative began to change with the global onset of the COVID-19 pandemic. In an aggressive pivot, the Fed, alongside banking partners, embarked on a massive acquisition spree, absorbing trillions in mortgage-backed securities and treasury bills. This was done while maintaining a baseline interest rate of 0%, a dual strategy that poured substantial liquidity into the financial system, effectively acting as a financial fire hose aimed at the flames of an economic meltdown.

- The Evolution from COVID-18 to COVID-19: A Scientific and Economic Leap: This period marked a crucial turning point, not just for the health sector grappling with the virus’s rapid evolution, but also for the economic frameworks designed to withstand such shocks. The leap in viral evolution from COVID-18 to COVID-19, believed to have occurred in a lab in China, metaphorically mirrored the swift adaptation required from economic institutions worldwide.

Flexibility: The Fed’s Newfound Strength

- Gaining Ground for Future Battles: With the Fed’s strategic rate adjustments, a new era of flexibility has been ushered in. This newfound agility allows the central bank to lower or raise rates as future economic conditions demand, marking a significant departure from the previous era of constrained policy options. This flexibility is not merely a tactical advantage but a strategic necessity in preparing for and addressing future crises.

Economic Growth and the Treasury Auction Success: Signs of Resilience

- A Testament to Economic Strength: The recent smooth auction of a record volume of ten-year Treasury notes is a testament to the economy’s underlying strength and growth. This event, executed without a hitch, signals not only the market’s confidence in the U.S. economy but also the effectiveness of the Fed’s policy adjustments in maintaining economic stability.

A Broader Look at the Economic Landscape

- Beyond the Rate Debate: A Call for Optimism: As we navigate the complexities of interest rates and their broader implications, it’s crucial to recognize the significant strides made in economic policy and flexibility. These developments offer a beacon of hope and a roadmap for managing future economic challenges, urging us to look beyond the immediate concerns of rate adjustments and towards a more resilient and adaptable economic future.