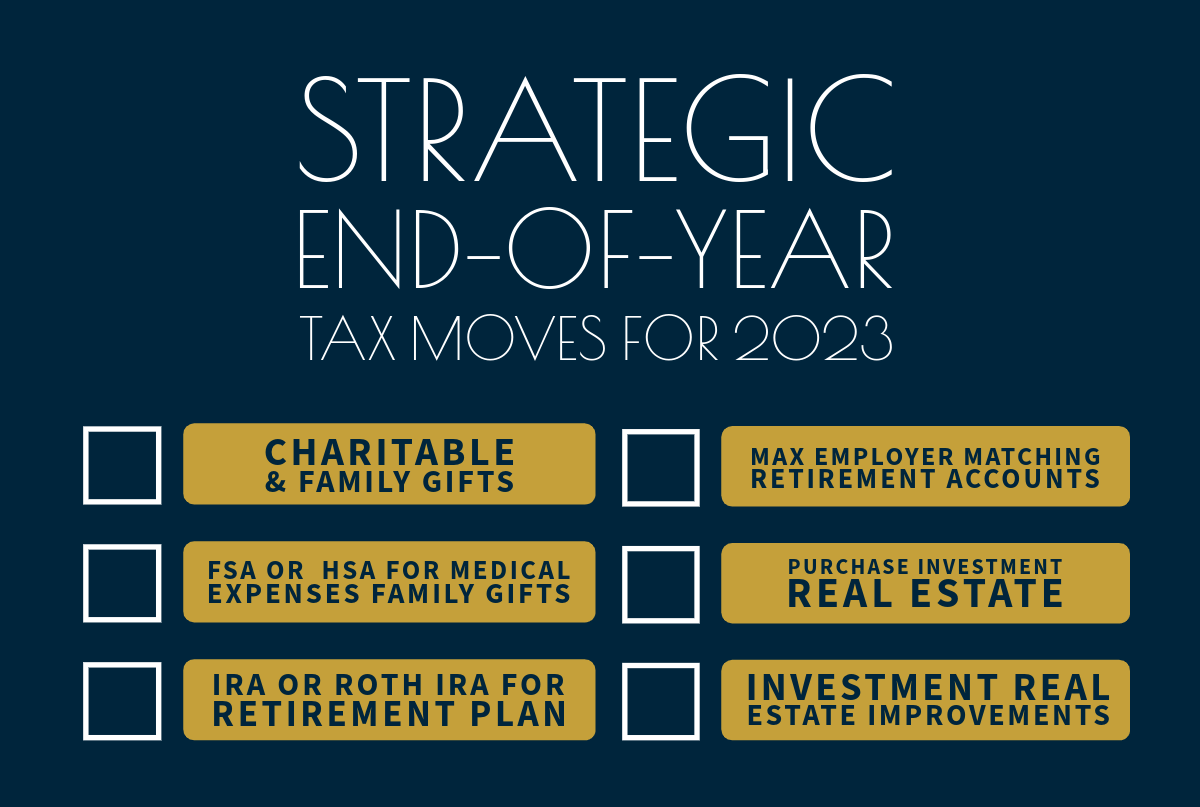

Key Takeaways:

- Complete charitable and family member gifts.

- Fund FSA or HSA for medical expenses

- Fund IRA or Roth IRA for retirement plan

- Max out employer matching retirement account

- Purchase investment real estate

- Fund investment real estate improvement

- Complete Charitable and Family Member Gifts

- Fund FSA or HSA for Medical Expenses

- Fund IRA or Roth IRA for Retirement Planning

- Max Out Employer Matching Retirement Accounts

- Purchase Investment Real Estate

- Fund Investment Real Estate Improvements

Generosity not only benefits others but can also yield tax advantages. Consider completing any charitable contributions or family gifts you’ve planned for the year. Not only does this support causes close to your heart, but it can also offer tax deductions.

Maximize contributions to your Flexible Spending Account (FSA) or Health Savings Account (HSA) for medical expenses. These funds are often tax-exempt, reducing your taxable income while providing financial support for healthcare needs.

Contribute to Individual Retirement Accounts (IRAs) or Roth IRAs to bolster your retirement savings. These accounts offer tax advantages, providing a dual benefit of saving for the future while potentially reducing your taxable income.

Take advantage of employer-matching retirement accounts such as 401(k)s or 403(b)s by maximizing contributions. Employer matches are essentially free money and contribute to your financial growth for retirement.

Purchase before the end of the year and receive deductions, depreciation and accelerate expenses into the current tax year providing immediate tax benefits.

Invest in improvements for rental real estate properties. Not only can this enhance the value of your assets, but it might also qualify for tax deductions or depreciation benefits.

These strategic end-of-year tax moves not only optimize your financial standing but also pave the way for a more prosperous future. Stay tuned for Part II, where we delve further into actionable strategies to navigate the year’s end effectively.