Key Takeaways

- Regional Growth Disparities: Global economic growth slowing; US, Saudi Arabia, and UAE outperform due to tech advancements and energy projects.

- North American Market Dominance: Maintains majority in public and private markets, with APAC, led by China, rising in private equity and venture capital.

- Resilience to Higher Interest Rates: US corporates show resilience with adequate EBIT to cover rising interest costs despite higher rates.

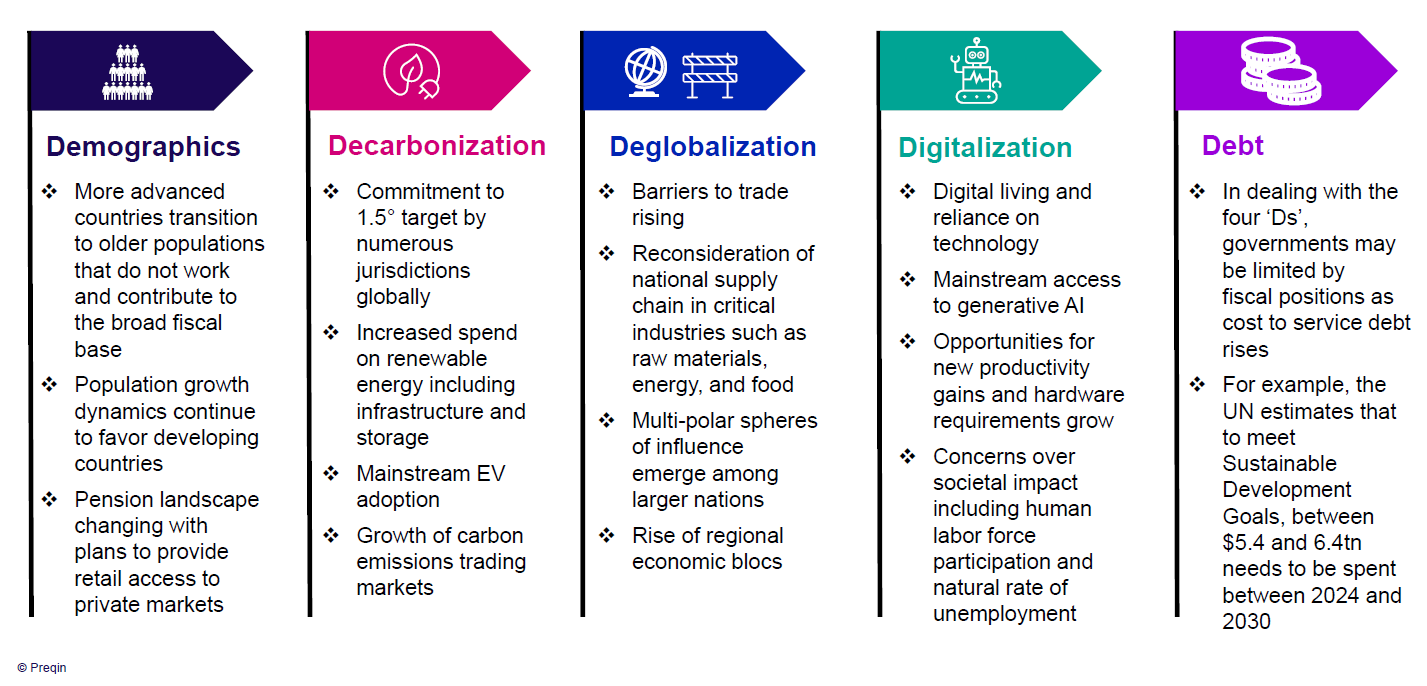

- Impact of ‘Four Ds’ and Debt: Investment trends are shaped by demographics, decarbonization, deglobalization, and digitalization, but high debt levels could limit growth.

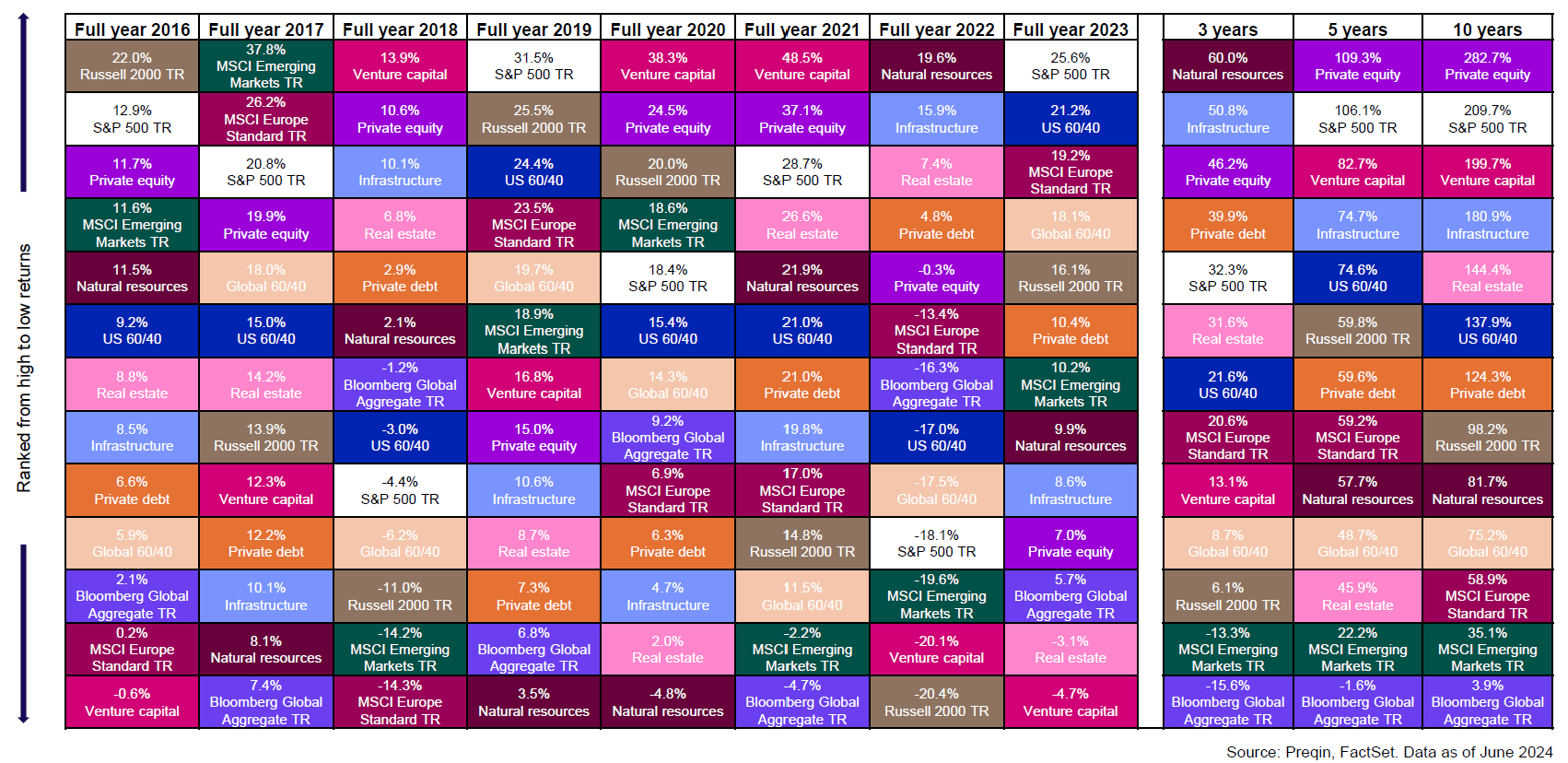

- Real Estate Stability: Real estate holds a positive long-term outlook with 10-year returns of 144.4%, showcasing stability and growth potential.

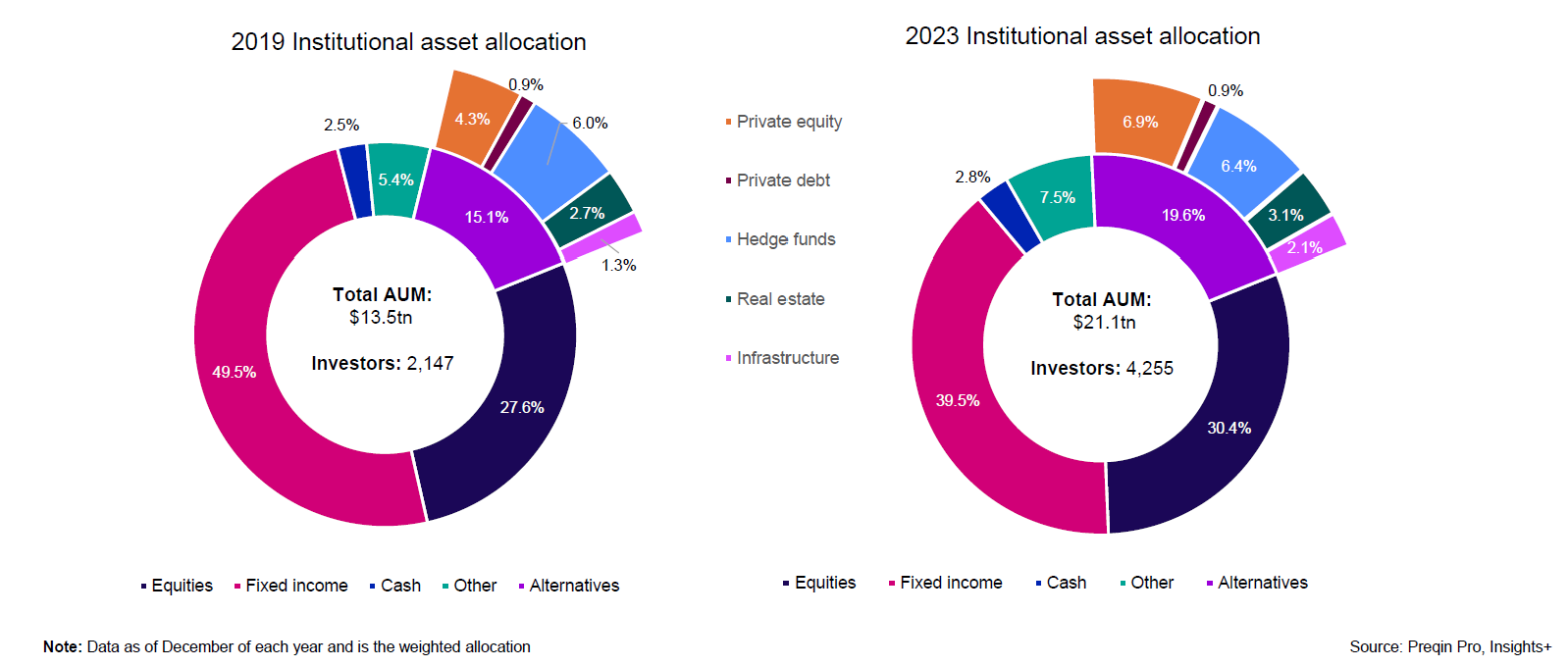

- Shift Towards Private Assets: Institutional investors are increasing allocations to private equity and other alternatives, seeking diversification and higher returns.

H1 2024 Investment Report: Market Dynamics and Strategic Insights

In the ever-evolving landscape of global investments, the first half of 2024 has presented both challenges and opportunities. As we navigate through these shifting dynamics, several key trends and insights emerge, painting a picture of where we stand and where we might be headed.

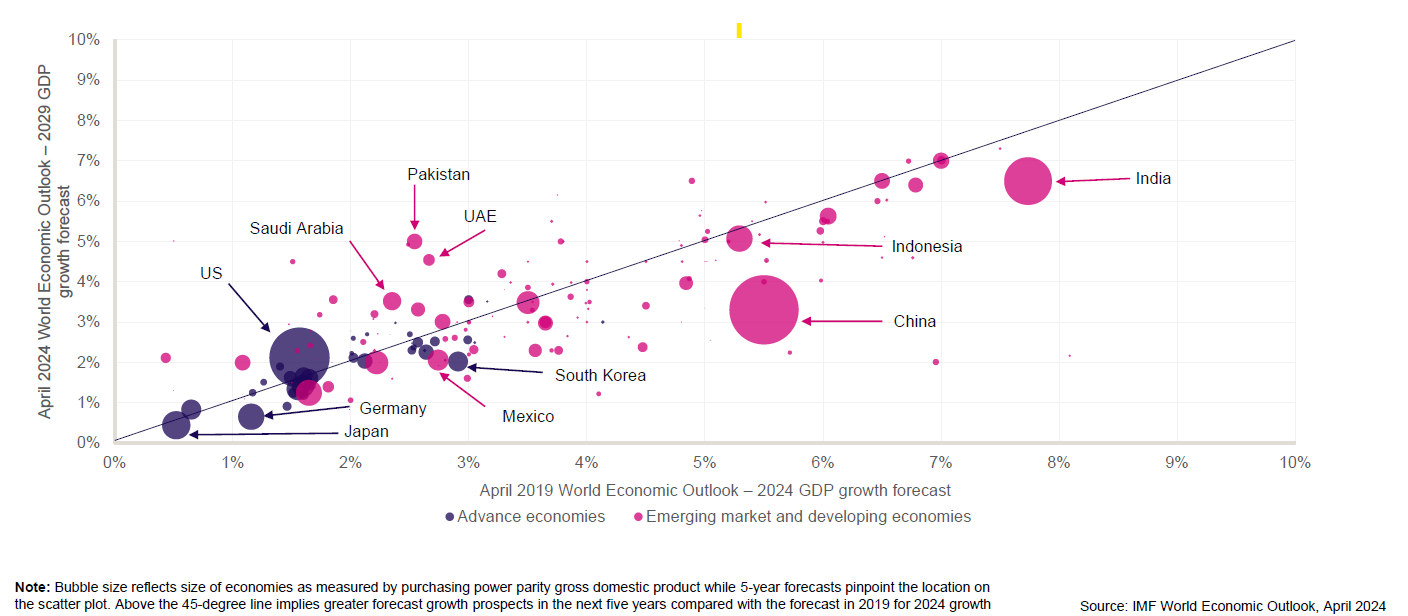

Global Growth to be Slower but US, Saudi Arabia, UAE Above Trend

The global economic outlook for the next five years suggests a slowdown in growth for most advanced and emerging economies. Yet, the US, Saudi Arabia, and UAE are projected to outpace this trend. The IMF’s April 2024 World Economic Outlook highlights robust growth in these nations due to technological advancements, energy independence, and strategic investments in diversification and sustainable energy projects. Emerging markets like India and Indonesia also show promise, driven by large, dynamic economies and structural reforms.

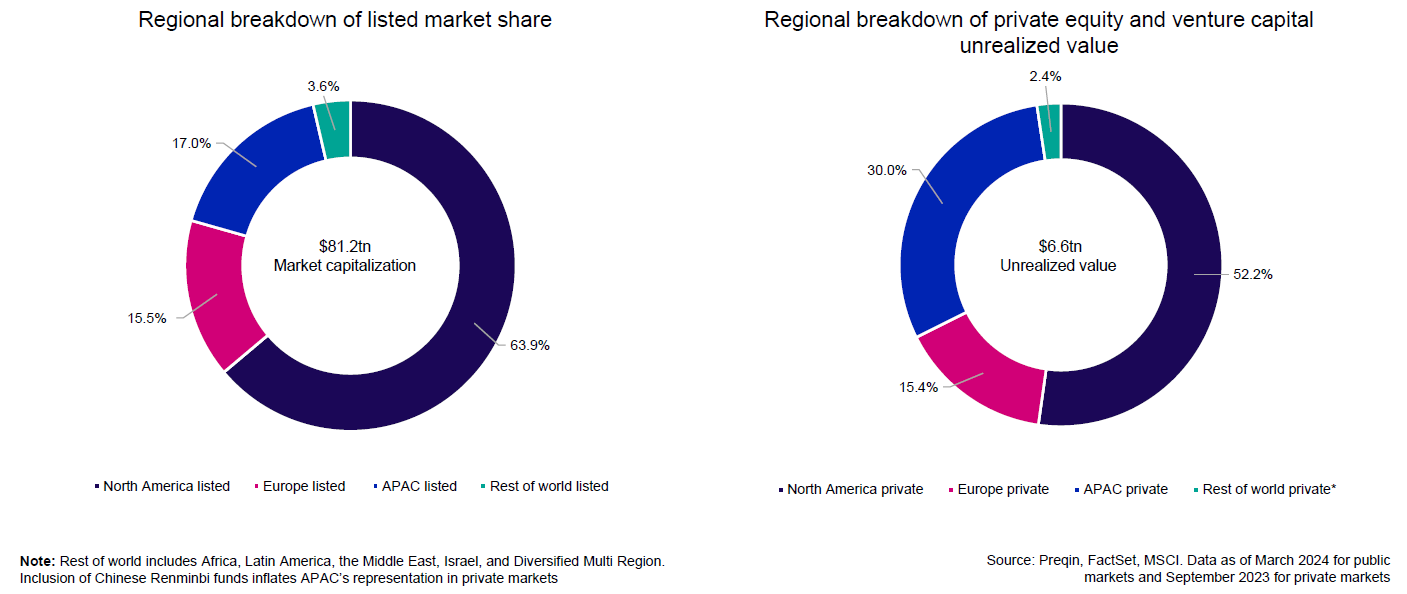

North America Dominates Listed Markets while China is focusing on Private Markets

North America continues to lead in public equity and private markets. As of March 2024, it holds 63.9% of the $81.2 trillion market capitalization in listed markets, with Europe and APAC following. However, in private equity and venture capital, APAC, significantly boosted by Chinese funds, represents a substantial portion of the $6.6 trillion in unrealized value. This highlights the growing influence of APAC in global private investments, even as North America maintains a strong but comparatively less dominant presence.

North America retains the majority share for both public equity and private markets, but Chinese funds play a major role in increasing APAC weighting in private markets

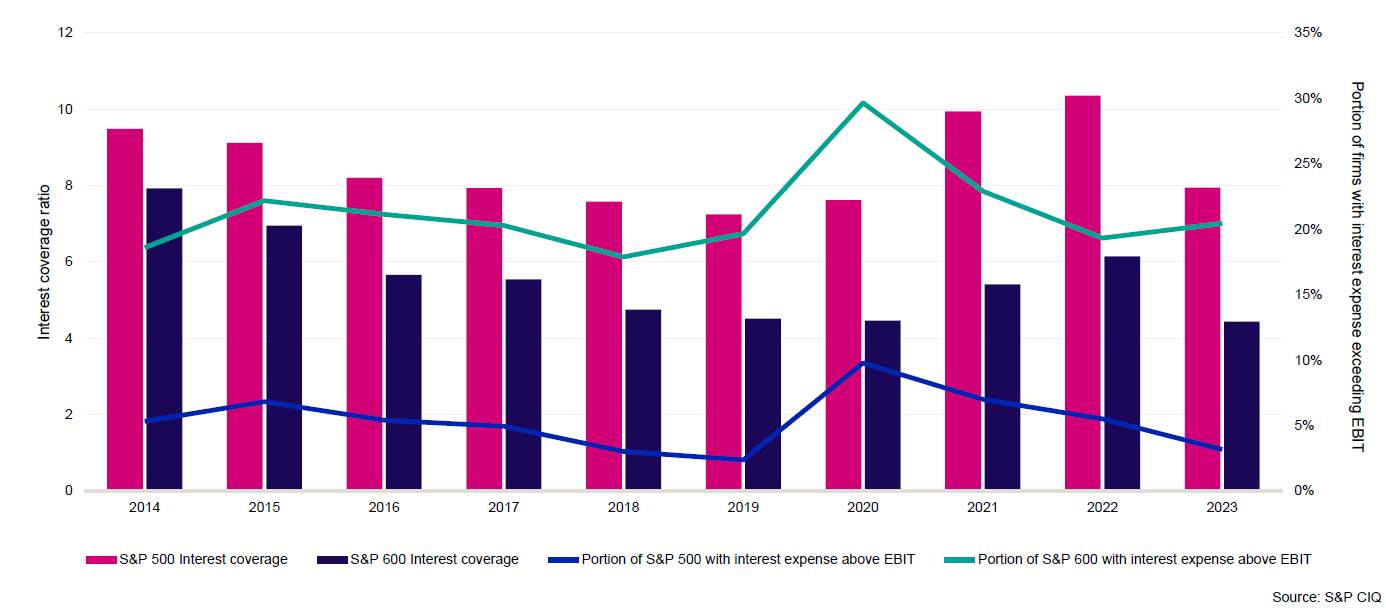

Impact of Higher Interest Rates on US Corporates Not Yet Severe

Higher interest rates have impacted US corporates, but not severely. Interest coverage ratios, indicating a company’s ability to pay interest on debt, have declined for both large and small firms but remain within historical norms. The S&P 500 and S&P 600 show a downward trend in these ratios. Despite these pressures, most firms still maintain sufficient earnings before interest and taxes (EBIT) to cover their interest expenses, demonstrating resilience amid rising borrowing costs.

Interest coverage ratios fall in both larger and smaller companies but remain within historical norms

Adding to the ‘Four Ds’ – Debt Overhang Will Likely Impact Growth

The ‘Four Ds’—demographics, decarbonization, deglobalization, and digitalization—are shaping the global economic landscape. Aging populations in advanced economies and favorable growth in developing countries highlight demographic shifts. Decarbonization drives investment in renewable energy and carbon trading. Deglobalization brings rising trade barriers and regional economic blocs. Digitalization increases reliance on AI and technology. However, these trends are complicated by high debt levels, with significant spending needed to meet global development goals, limiting governments’ fiscal flexibility.

History of Returns: Ranking Private Asset Performance

Private asset performance shows significant variability across asset classes. In recent years, venture capital and private equity have often led performance rankings, especially in 2020 and 2021. Natural resources surged in 2022, maintaining strong 3-year returns. Real estate holds a positive long-term outlook with 10-year returns of 144.4%, showcasing stability and growth potential. These variations highlight the importance of strategic asset allocation to optimize returns.

Institutional Investors Increase Allocation to Alternatives

Institutional investors have significantly increased their allocations to alternative assets. From 2019 to 2023, private equity allocation grew from 4.3% to 6.9%, reflecting a strategic shift. Total assets under management (AUM) rose from $13.5 trillion to $21.1 trillion. This growing preference for private debt, hedge funds, real estate, and infrastructure underscores the potential for higher returns and diversification benefits compared to traditional equities and fixed income.

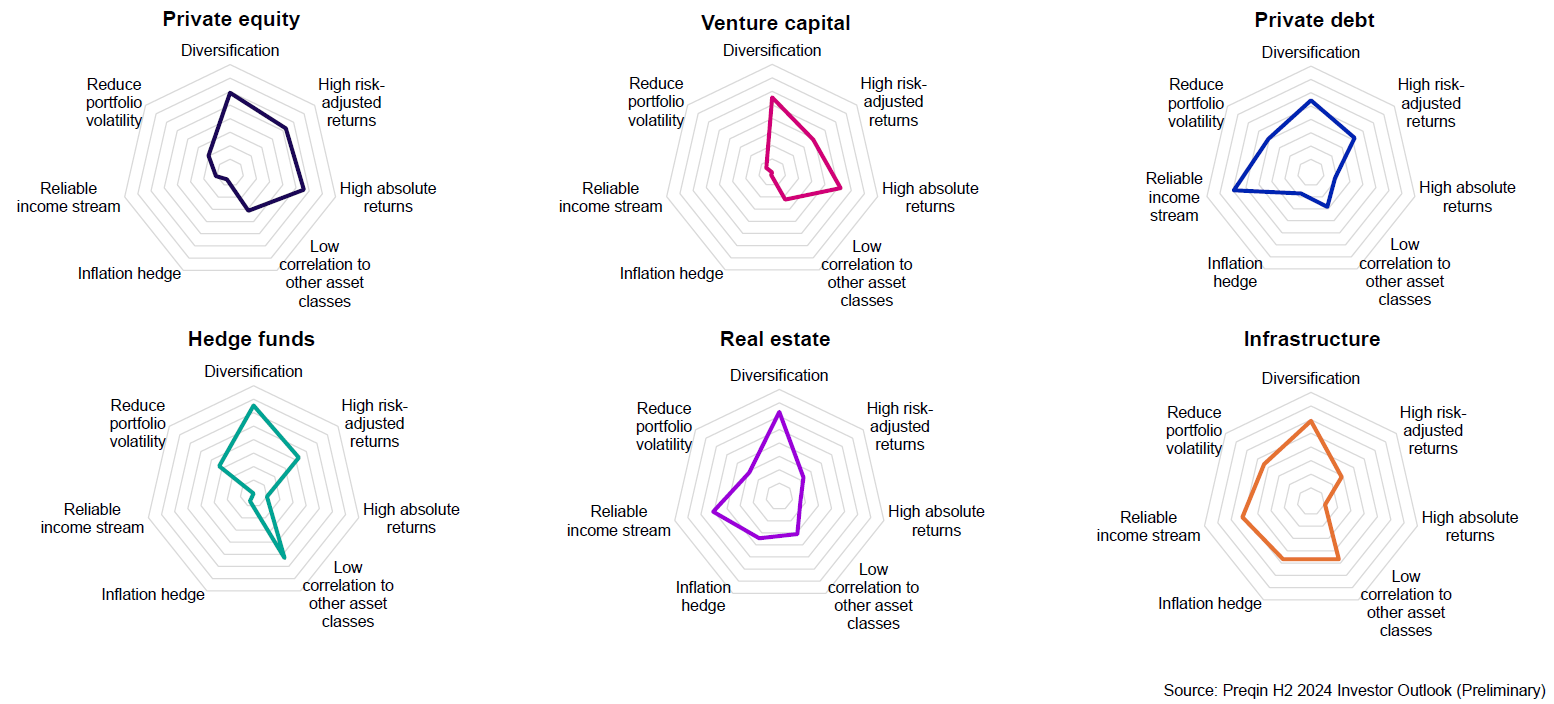

Diversification is the Top Reason Investors Consider Alternatives

Institutional investors are turning to alternative assets primarily for diversification.

In 2024, key reasons include:

- Private Equity: Diversification, high risk-adjusted returns, reliable income stream

- Venture Capital: High absolute returns, low correlation to other assets.

- Private Debt: Diversification, high risk-adjusted returns.

- Hedge Funds: Reduced portfolio volatility, reliable income.

- Real Estate: Diversification, stable income.

- Infrastructure: Reliable income streams, inflation hedge.

Institutional investors’ main reasons for investing in alternative assets in 2024 norms

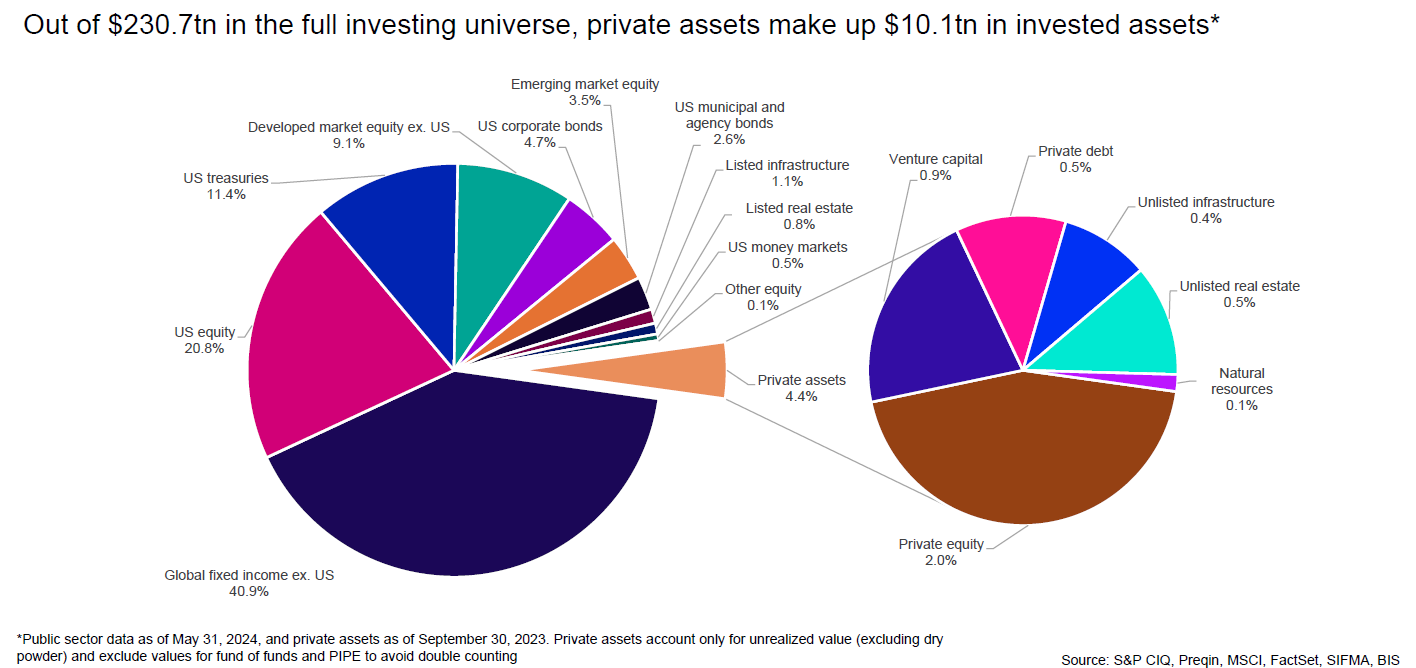

Private Assets Are Only 4.4% of the Current Investing Universe

Private assets make up a small fraction of the global investing universe, accounting for 4.4% of the $230.7 trillion total, including $10.1 trillion in invested assets. The majority is dominated by global fixed income, excluding the US (40.9%), US equity (20.8%), and US treasuries (11.4%). Despite their small share, private assets like private equity, private debt, venture capital, and real estate are crucial for portfolio diversification and high returns, attracting increasing interest from institutional investors. Real estate, in particular, is valued for its stability and long-term growth potential.