Investments in real estate stand out as a relatively safer haven, primarily due to its unique characteristic of having an underlying asset that has demonstrated a consistent historical trend of increasing in value.

Yet, despite its allure, navigating the world of real estate investments requires careful consideration and evaluation of specific factors that can significantly impact your investment decisions.

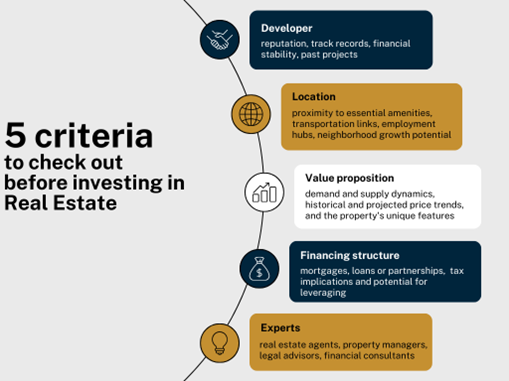

- The Developer

The developer and particularly its reputation, plays a pivotal role in the success of any real estate investment. An established and reputable developer not only ensures the quality of construction but also instills confidence in the project’s completion.

The key criteria to check out for during the due diligence process are the developer’s track record, financial stability, and past projects. These would allow you to assess their reliability.

A developer with a history of delivering on promises is more likely to ensure the timely completion of your property, protecting your investment from potential delays and uncertainties.

- Location/Geography of the Property

The adage “location, location, location” in real estate couldn’t be more accurate. The geographic placement of a property is a fundamental factor that can significantly influence its long-term value and rental potential. A well-chosen location can lead to consistent appreciation, rental income, and overall desirability.

Factors to consider include proximity to essential amenities, transportation links, employment hubs, and neighborhood growth potential.

- Value Proposition

Investing in real estate is not solely about buying property; it’s about making an informed financial decision.

Evaluating the value proposition of a property involves assessing its potential for appreciation, rental income, and overall return on investment. Consider the demand and supply dynamics of the specific market, historical and projected price trends, and the property’s unique features that can enhance its value.

- Financing Structure

Carefully examine your options for financing, such as mortgages, loans, or partnerships, and evaluate their terms, interest rates, and potential impact on your cash flow. Additionally, consider the tax implications and potential for leveraging your investment to maximize returns while managing financial risks.

- Experts

Carefully assess the experts the developer is working with: do they understand the local market and the legal requirements?

Some of the experts the Fund Manager and the Developer would work with are real estate agents, property managers, legal advisors, financial consultants, and so on.

Take some time to collect some feedback and check on their reputation.

Conclusion

As you venture into the dynamic world of real estate investments, remember that success comes from digging deep and doing your homework.

Whether you’re a rookie or a seasoned pro, it’s all about making choices that truly sit right with your gut feeling and financial dreams. So, roll up your sleeves, dive into the research, and find that perfect property that makes you say, “This is it!”